By John Caughlin

Gilead, one of the most stories biotechnology companies globally, creates medicines for some of the most life-threatening illnesses. The company has currently approved medication for HIV/AIDS, liver diseases, and a wide variety of other bodily diseases.

In the past year, Gilead’s remdesivir has gained considerable recognition in its treatment for Covid-19. In the description of their fight against Covid-19, the company mentioned that “In the United States, the Food and Drug Administration (FDA) has authorized the emergency use of remdesivir to treat hospitalized adult and pediatric patients.” Although this may be great news to Gilead, the company is growing at a slower rate, and in their reported Q1 financial results, reported a 21% decrease of net income from 2019 to 2020, or $1.975 to $1.55 billion. With the company going in the wrong direction, can the new man in charge, Daniel O’Day, turn things around?

A New Sheriff in Town

In March of 2020, Gilead announced that Daniel O’Day would serve as “Chairman of the Board of Directors and Chief Executive Officer.” Before being the Gilead CEO, O’Day served as the CEO of Roche Pharmaceuticals and other roles for over twenty years. On their website, the Swiss biotech company states, “We have been at the forefront of cancer research and treatment for over 50 years, with medicines for breast, skin, colon, ovarian, lung and numerous other cancers.” With being such a successful company in the cancer field, amassing a market share of over $300 billion, this experience from O’Day will be vital in Gilead’s further research and treatment of cancer.

Gilead’s Acquisition of Kite Pharma

Known for their many types of medication for severe illnesses and diseases, Gilead, in recent years, has started a new journey in treating and stopping the spread of cancer.

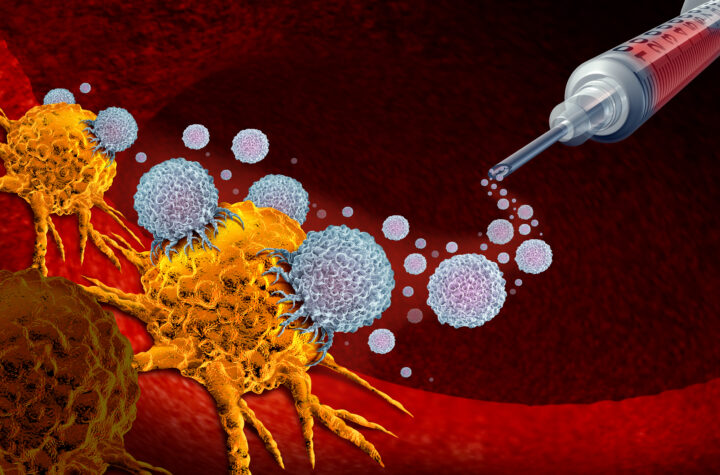

On August 28, 2017, Gilead, in a significant move, acquired Kite Pharma for $11.9 billion in cash. This acquisition, as suggested by Gilead in their announcement, “immediately positions Gilead as a leader in cell therapy.” Before the acquisition, Kite Pharma was “an industry leader in the emerging field of cell therapy, which uses a patient’s own immune cells to fight cancer.”

Among their excitement for the acquisition of Kite Pharma, Gilead was most interested in Kite’s Axicabtagene ciloleucel, a “CAR T therapy candidate.” Before the acquisition, Axicabtagene ciloleucel was approved by the FDA for adult use in treating large B-cell lymphoma. By acquiring Kite Pharma, Gilead could now use this therapy and similar candidates to treat the spread of cancer. Through just one acquisition, Gilead has positioned themselves for success in the cancer treatment field.

Gilead’s Acquisition of Forty Seven

Along with their acquisition of Kite Pharma, Gilead has also acquired another cancer research company, Forty Seven. On March 2, 2020, Gilead announced that they would acquire Forty Seven, Inc. for $4.9 billion. In their announcement, the Gilead mentioned Forty Seven’s “Investigational Immuno-Oncology Therapy” or according to CancerCare “the study and development of treatments that take advantage of the body’s immune system to fight cancer.” Within Gilead’s interest in this acquisition lies Forty Seven’s magrolimab, “a monoclonal antibody in clinical development for the treatment of several cancers.” Although less than half of the price of Kite Pharma, this acquisition allows Gilead to venture further into the cancer treatment field through Immuno-Oncology. Hey, if you can’t beat them, buy them!

Gilead’s Agreement with Arcus Biosciences

Gilead doesn’t just buy out their competitors or future competitors but also make agreements with, like Arcus Biosciences. On May 27, 2020, Gilead announced a “10-year Partnership to Co-develop and Co-commercialize Next-generation Cancer Immunotherapies” with Arcus Biosciences. Acrus, similar to Gilead’s other acquisitions, makes therapies and drugs for battling the spread of cancer. According to Gilead, this partnership will “Access to Arcus’s Clinical and Preclinical Pipeline of Immuno-Oncology Product Candidates that Target Critical Biological Pathway.” Gilead, in a 6-month timespan, has set up a far-reaching control of the cancer treatment business with new technology by acquiring and partnering with companies.

Gilead + Kite Pharma = Cancer Treatment and Approvals

Through the acquisition of Kite Pharma, Gilead has also acquired Kite’s T Cell Therapy. According to Gilead, “Cell therapy is a cutting-edge approach that begins with collecting a patient’s T cells through a process called leukapheresis.” The cells are then modified to target specific cancer cells, which Gilead calls “Harnessing the power of the immune system to treat cancer.” According to Gilead, T Cells “sometimes fail to recognize and eliminate tumors.” Although, with Kite Pharma’s CAR T Process, which engineers T cells to attack cancer cells, the immune system can effectively attack cancer tumors.

On July 24, 2020, the U.S. FDA approved Kite Pharma’s Tecartus™, a “CAR T Treatment for Relapsed or Refractory Mantle Cell Lymphoma.” This approval is the first of its kind, regarding CAR T treatment and crowns Kite Pharma as “First Company with Multiple Approved CAR T Therapies.” Tecartus™ or brexucabtagene autoleucel shows significant results in ZUMA-2, “a single-arm, open-label study.” Patients who were given Tecartus™ showed an 87% response rate and a 62% complete response rate. These results show promising results for the future of T Cell Therapy. With Kite Pharma owning a significant market share and approval share of this new therapy, any new approval or progress will significantly impact Gilead.

Financials and Cancer Treatment

As previously stated, Gilead, throughout the past year, has been struggling with revenue growth and net income. In its most recent quarterly earnings report, Gilead reported a 7% decrease in Q2 revenue compared to Q1. In response to their weak financial report, Gilead stated that Covid-19 has significantly affected their patient starts, which have led to lower sales in treatments, such as Ranexa and Letairis. Although company revenue may be lower due to the pandemic, Gilead has previously seen slower growth in recent quarters, not attributed to Covid-19.

With Gilead reporting weak revenue and sales results due to Covid-19, the cancer research and further treatment may become more viable to company revenue. As previously stated, the CAR T Treatment has gained further recognition through the July 24 approval, even during the pandemic. If Kite Pharma can obtain additional approvals from their new cancer therapy, and bring treatments to the market, Gilead’s revenue will likely increase. With Gilead seeing slower growth over the past years, Kite Pharma’s new cancer therapy may provide needed revenue growth in the cancer field.

Gilead’s Stock

Gilead, under the ticker symbol (NASDAQ: GILD), has seen stagnant growth over the past year and a constant downtrend over the past few years. Currently, Gilead is 40% off its all-time highs and sits at $70 share. If Gilead, with a new CEO and Kite’s new cancer therapies, can see new growth, investors may find a reason to buy into Gilead’s falling trajectory.

For a value investor, Gilead is the perfect stock to own. With a 3.91% dividend yield and smaller percentage moves, an investor can be comfortable to hold Gilead during unstable times like Covid-19.

The Future ford Gilead and Kite Pharma

Gilead’s future, although being darkened by decreasing revenue, remains relatively bright. With treatments ranging from HIV, Covid-19, and other severe diseases, Gilead is well diversified. In particular, with their new acquisition of Kite Pharma, their market share of CAR T therapies will enable them to grow revenue if such methods prove successful.

Their new CEO, Daniel O’Day, will only provide more support in the cancer research field and company growth along with their diversified medicine and treatments. Although Gilead may not be in the glory days regarding company growth, prospects such as cancer treatment and CEO guidance provides an investor with the assurance of Gilead’s great future.

2 thoughts on “GILEAD: DANIEL O’DAY DOES M&A”

Comments are closed.