Up and coming Wall Street analyst Kody Kester makes the case for Amgen. Strong Cash Flow, affordable valuation, and a growing innovation pipeline make $AMGN a solid bet for yield hounds looking for a mature biotech investment for the long haul…

Dividend growth investors such as myself are constantly searching the market for investment opportunities that offer current dividend yield, dividend safety, and dividend growth.

An industry that is certainly more than capable of offering this solid risk/reward profile is the pharma industry.

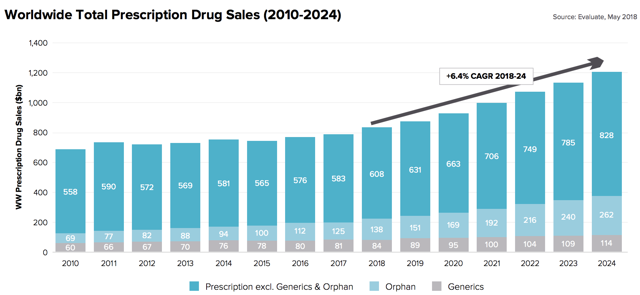

Source: Evaluate Pharma

When we take into consideration that the world is growing larger, wealthier, and older (due in large part to technological advances in medicine), it becomes quite clear that the demographics demonstrate that prescription drug sales are set to do quite well in the years ahead, likely delivering a 6.4% CAGR through 2024.

The best way to take advantage of this long-term macroeconomic trend is to invest in the best available pharma companies at fair or better prices.

I’ll detail why I believe Amgen fits the above profile.

Amgen’s Dividend Is Safe And Growing Moderately Fast

When we consider that Amgen’s non-GAAP EPS in 2018 was $14.40 against the $5.28 paid out during that time, the dividend is clearly safe at a 36.7% payout ratio during 2018. It also also clearly safe when we take into consideration that Amgen is expected to pay out $5.80 in dividends during 2019 against a non-GAAP EPS midpoint of $13.70 for 2019 (due in large part to Enbrel’s 8% YOY decline in sales).

Examining the FCF payout ratio, this is roughly the same with Amgen generating FCF of $10.6 billion against the $3.5 billion paid out during 2018, and this FCF payout ratio will be only a bit higher in 2019.

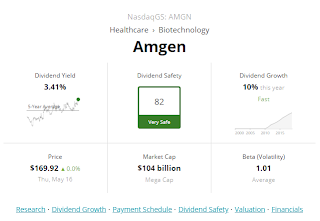

Image Source: Simply Safe Dividends

As one could imagine, Simply Safe Dividends agrees with my assessment that Amgen’s dividend is safe. The next important factor for consideration pertains to Amgen’s ability to grow its dividend in the future.

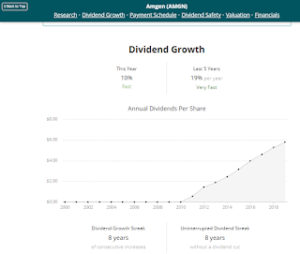

Image Source: Simply Safe Dividends

While it isn’t likely Amgen will be able to continue its 5 year DGR, I do believe that high single digit dividend increases are going to be the status quo over the next 5-10 years as Amgen’s overall earnings growth and a modest expansion in Amgen’s payout ratio should support this type of dividend growth. Next, we’ll delve into the growth catalysts for Amgen.

A Difficult 2019 Ahead, But Stabilizing Years Of Growth Beyond

While Amgen’s product sales fell about 1% from Q1 2018 to Q1 2019 as detailed in Amgen’s Q1 2019 Earnings Presentation, it’s worth mentioning that the company’s legacy drugs such as Neulasta, Sensipar, and Epogen all had experienced sales declines from Q1 2018 to Q1 2019, and that is the major reason for the slight YOY sales decline.

The reason for my optimism toward Amgen lies in the fact that the company has a truly deep pipeline and the recent commercial release of migraine prevention drug Aimovig and Q1 2019 sales of $59 million is reason to be optimistic. Aimovig is in the early innings of its growth story and Fierce Biotech predicts the drug will reach peak sales of $1.2 billion a year. The continued double digit sales growth in Repatha is also cause for optimism.

While key drugs like Neulasta, Prolia, and the company’s leading drug Enbrel are set to face fierce competition from other companies looking to market biosimilars of the drugs, and this will likely force a price cut and decline in margins on those drugs, Repatha and Aimovig are likely to be major drivers of the 5.4% average annual earnings growth over the next 5 years that Nasdaq is predicting.

In short, Amgen’s continued aggressive R&D spending will drive innovation and foster growth in the years ahead, and the share buybacks will also contribute to Amgen’s earnings growth in the years ahead.

Key Risks To Consider:

The key risks to consider before placing an investment in Amgen include the fact that like any pharma company, Amgen must continue to innovate to stay relevant and deliver satisfactory returns for investors.

Yet another risk for investors to consider is that even though Amgen is going to continue to spend billions on R&D, that spending doesn’t always translate into future financial results. After all, less than 1% of the pharma industry’s drugs actually deliver results in clinical trials and reach the commercial market.

These risks aren’t even considering the ultimate risk facing any pharma or healthcare company for that matter. The regulatory risk involved with the increasingly unfavorable public perception of big pharma and politicians that are ramping up their rhetoric against big pharma across both aisles is concerning and must be taken into consideration.

While I highly encourage investment into the healthcare industry and more specifically the pharma industry, investors need to be careful and make sure they are properly diversified with a healthcare weighting in their portfolio that they are comfortable with.

These risks are what I believe to be the key risks to Amgen. However, that isn’t to say there aren’t other risks and I would refer interested readers to pages 22-38 of Amgen’s most recent 10-K for a more comprehensive listing of the risks to Amgen.

Amgen Is An Excellent Company Trading At A Discount

Using dividend yield theory, we can see that Amgen’s current dividend yield of 3.39% (as of May 17, 2019) compares rather favorably to the company’s 5 year average dividend yield of 2.61%, per Simply Safe Dividends. If you believe that Amgen’s fundamentals haven’t markedly deteriorated recently, this increased yield which is nearing an all-time high for Amgen offers investors a solid investment opportunity.

Even in a conservative scenario that assumes the fair value yield for Amgen going forward is 3%, this would imply that Amgen’s shares are trading at an 11.5% discount to fair value and offer upside of 13%, from the current share price of $171.10 to the fair value of $193.33.

Nearly any valuation metric of Amgen’s that you examine supports the overall theory that Amgen is trading at a discount of some extent compared to its fair value.

Closing Thoughts

Amgen is the definition of a blue-chip and one of the closest things to a sure thing in an uncertain world. Its massive size and scale within an industry that is expected to benefit as the population grows older, richer, and larger will likely serve the company and its shareholders well over the long-term.

To add to the attractiveness of Amgen’s shares, the company offers 13% upside from its current share price on top of the likely 5% earnings growth, and 3.4% starting yield. When we put all of that together, Amgen’s shares are likely to deliver 10.9% annual total returns over the next 5 years, which will likely outperform the market during that time.

I’m really enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more pleasant for me to come

here and visit more often. Did you hire out a designer

to create your theme? Excellent work!