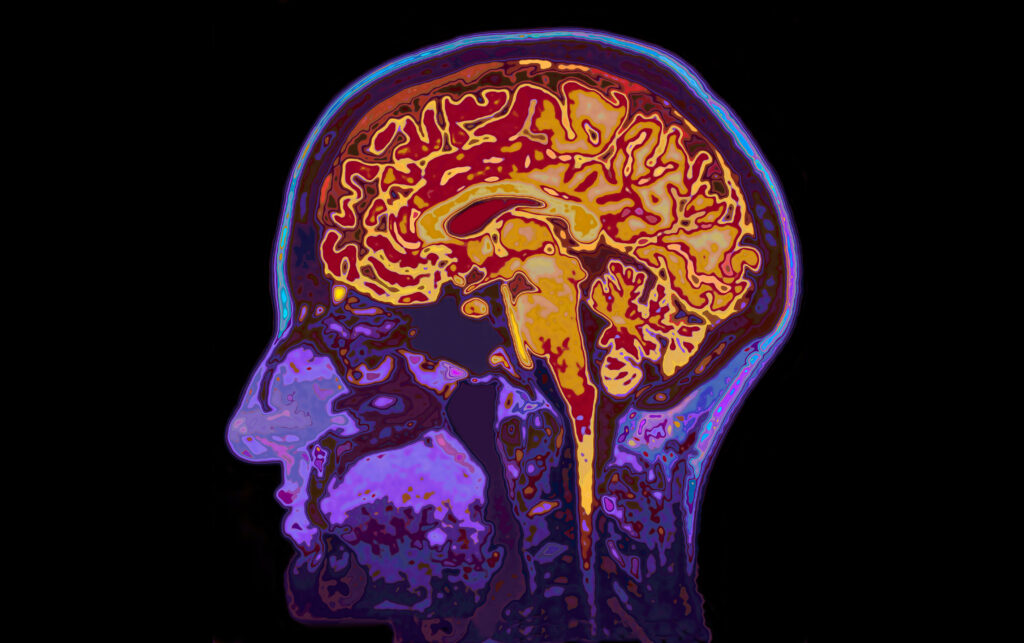

First rule of healthcare: do no harm. Perhaps that is why Biogen’s drug aducanumab was so controversial. To really understand how aducanumab works, it’s important to understand Alzheimer’s first. As the sixth leading cause of death in the U.S., Alzheimer’s disease progresses when proteins clump up to form amyloid plaques. This build-up leads to brain cell death because they lose their function and can’t communicate with each other. To slow down the disease from progressing rather than curing or reversing it, aducanumab works to reduce these amyloid plaques. However, there is a lot of controversy around this drug because it hasn’t been proven efficacious nor safe. It has proven effective in reducing amyloid plaques, but it did not improve cognitive function, which defeats the whole purpose of the drug. The direct correlation between reducing these plaques and memory improvement is still unclear, but aducanumab has not shown clinical significance. In fact, in clinical trials, 30% of patients experienced reversible brain swelling with over 10% getting minor brain bleeds. So the real question is, why and how did it get approved by the FDA on June 7, 2021? Some claim that it was to give this medication a chance since there has not been any drugs approved in the last 18 years for Alzheimer’s disease.

Following the criticism, FDA limited the inclusion criteria for those with only mild cognitive impairment or dementia. But defining “mild” becomes very tricky because it requires expensive PET scans that aren’t readily available in hospitals or lumbar punctures that have procedural risks. Adacanumab debuted with a hefty annual price tag of $56,000, which does not include the actual cost of getting the infusion every 4 weeks (for potentially the rest of the patient’s life) and expensive monitoring tests like MRIs. Recently, this price tag has been slashed, but the poor sales of the drug have given the whole affair the feeling of a used car dealer desperate to move unloved inventory.

Due to the complexities of Alzheimer’s disease, there is currently no cure. In fact, aducanumab is the first medication that targets the course of the disease rather than just relieving symptoms. But what else is out there? Is there hope? Let’s explore three of the medications that are currently in phase 3 clinical trials for Alzheimer’s disease.

1. Lecanemab – by Biogen ($BIIB) and Eisai ($ESALY)

As the “pioneers in neuroscience”, will Biogen make a comeback from the controversies of aducanumab? Biogen partnered up with Eisai to pursue another innovation together. Their investigational drug, lecanemab, received breakthrough therapy designation from the FDA, which means that its review and potential approval will be expedited since Alzheimer’s is a serious condition with unmet needs.

One of the main concerns with aducanumab was the amyloid-related imaging abnormalities (ARIA), which include swelling and bleeding in the brain. However, phase 2 data for lecanemab seem more promising as the incidence of ARIA for lecanemab was 10 percent compared to 35 percent for aducanumab. Even though 10% is still a high number for such serious side effects, Biogen is still on the right track for improvement. In addition, lecanemab slows down the progression of Alzheimer’s disease by reducing the amyloid protein plaque development. It won’t cure Alzheimer’s disease, but it can help prolong mental sharpness in those with mild Alzheimer’s disease. This study is expected to end by September 2022, so stay tuned.

2. Gantenerumab – by Roche ($RHHBY)

One unique feature about gantenerumab is that it can be injected subcutaneously under the skin, just like insulin. It makes it much more convenient for patients because they could possibly administer it themselves at home. They would not have to go to the hospital for an intravenous infusion like they do for aducanumab or lecanemab if it gets approved. Also, unlike aducanumab which has to be administered for about an hour once a month for possibly the rest of the patient’s life, gantenerumab is administered for 5 minutes once a month for two years.

In 2014, Roche ended gantenerumab’s phase 3 trial early due to lack of efficacy. However, it brought it back in 2018 after promising data that a higher dose is efficacious in removing amyloid plaques. The higher dose led to a 80% reduction in amyloid plaques, which led to the FDA granting gantenerumab with breakthrough designation therapy.

3. Donanemab– by Eli Lilly ($LLY)

The biggest perk of donanemab is that it removes plaque faster than any of its competitors in development. From its phase 2 study, at 24 weeks, the significant decrease in amyloid plaques led to decreased progression of cognitive decline.

To distinguish itself from its competitors, Eli Lilly is building an infusion and diagnostic infrastructure to make donanemab treatment more accessible and feasible for patients. One of the main challenges with this therapy is identifying the appropriate patient population. As mentioned earlier, diagnostic tests such as PET scans and lumbar punctures are not ideal in most situations. Addressing this challenge with a solution will enable the use of donanemab to be maximized appropriately.

Although all three of these pipeline medications have received breakthrough therapy designation from the FDA, it is hard to predict which one, if any, will receive the stamp of approval due to the complexities of Alzheimer’s disease. Aducanumab won FDA approval based on its ability to reduce amyloid plaque, not necessarily due to its impact on cognitive function in Alzheimer’s patients. Is plaque reduction simply enough for future medications to gain FDA’s approval? Or will FDA be expecting more the next time around? For approval, it is crucial for the phase 3 trial results to show that the drug is clinically meaningful and improves patients’ daily lives by enhancing their cognitive function while keeping their brain function stable.

More Stories

J&J: THE NEXT ELI LILLY?

HOW TO INVEST $10,000 TODAY

CANCER VACCINES: AN INJECTION OF PROFIT FOR YOUR PORTFOLIO?